Cash for colonoscopies: Colorado tries to reduce health care costs through incentives

State employees in Colorado are being asked to be better consumers when purchasing health care services. And if they choose lower-cost, higher-quality providers, they could receive a check in the mail for a portion of the savings. It's part of an initiative called the Colorado Purchasing Alliance, through which employers in the state band together to negotiate lower prices for health care services. The state government is one of 12 employers that have joined the alliance and will be the first to take advantage of the newly negotiated tariffs and consumer incentives. The goal is to disrupt what is seen as a dysfunctional healthcare market by encouraging employers and employees...

Cash for colonoscopies: Colorado tries to reduce health care costs through incentives

State employees in Colorado are being asked to be better consumers when purchasing health care services. And if they choose lower-cost, higher-quality providers, they could receive a check in the mail for a portion of the savings.

It's part of an initiative called the Colorado Purchasing Alliance, through which employers in the state band together to negotiate lower prices for health care services. The state government is one of 12 employers that have joined the alliance and will be the first to take advantage of the newly negotiated tariffs and consumer incentives.

The goal is to disrupt what is seen as a dysfunctional health care market by encouraging employers and employees to make better decisions and forcing the state's health systems - which have some of them highest prizes and winnings in the country – to lower their prices.

Since July 1, state employees have had access to the Healthcare Blue Book, an online tool from the eponymous health data company that ranks healthcare providers based on both cost and quality. Vendors in the top 25% for quality are marked in green, the bottom 25% in red, and everything in between in yellow. The same color scale is used for costs.

“If you go to a green-green provider, we’ll send you a check,” said Josh Benn, director of employee benefits contracts for the Colorado government.

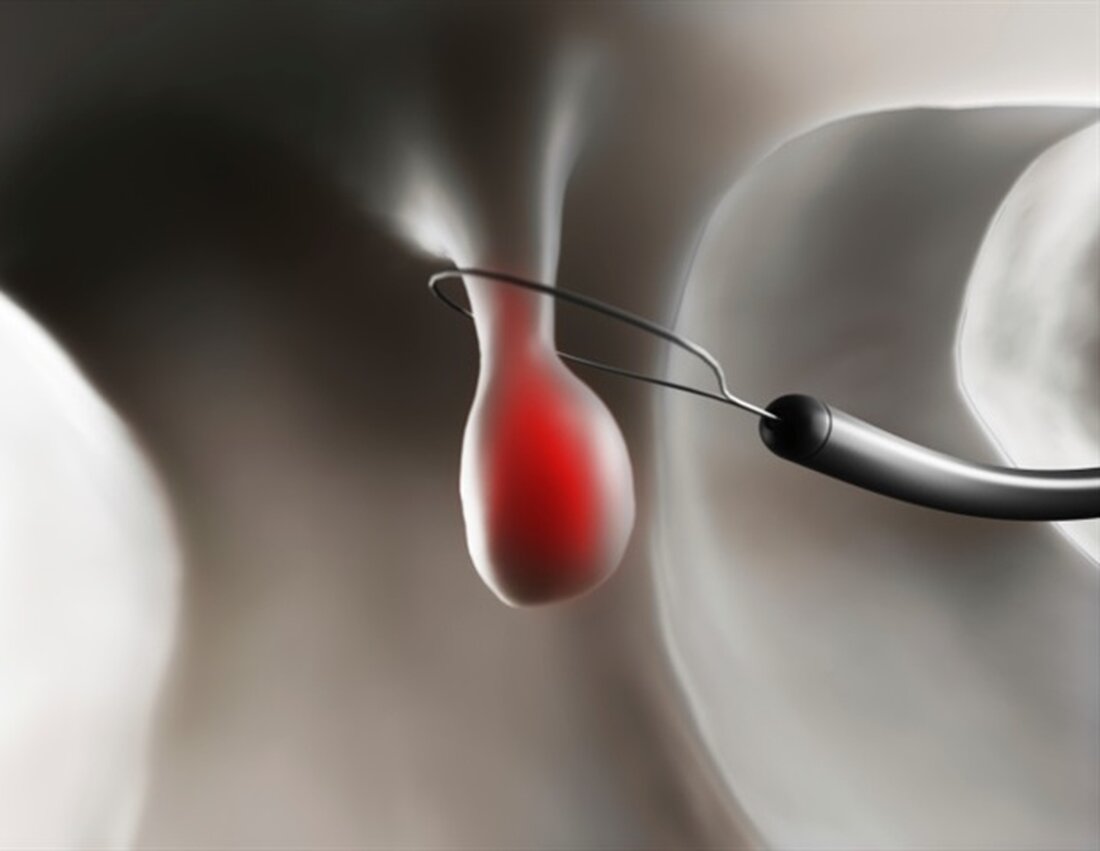

The checks can range from less than $50 for something like a mammogram to thousands of dollars for surgery. In most cases, the money helps offset the employee's copays, coinsurance or deductible. But for preventive services like colonoscopies, which have no copay, it's extra money in the employee's pocket.

The rewards program is only available to employees who choose the state's self-funded health plan, which is administered by Cigna, rather than the Kaiser Permanente option, which has a closed network of providers. Of the nearly 20,000 people, both employees and family members, on the Cigna plan, more than 1,200 used the tool in the first six weeks and conducted 4,500 searches.

“We could cut the network to the bone and really limit the choices, but part of what I want to do is encourage people to make better choices,” Benn said. “There are ways to curb healthcare spending without harming employees.”

Although it's too early to tell how much the state will save through the program, Healthcare Bluebook estimates that employers will save an average of $1,500 each time an enrolled member uses the online tool to select a provider.

“And in the end, you have fewer complications and sick days,” Benn said.

Larimer County in northern Colorado has used Healthcare Bluebook in its incentive program since 2018 to address the high prices it paid for employee care under its self-funded plan. With little competition, local health systems charged county employees nearly double the prices in Denver, just two hours south.

“We have a particularly dominant health system here that knows that it is the system of choice based solely on market reputation, and it is willing and able to charge accordingly,” said Jennifer Whitener, benefits manager for the county.

Whitener recalled an employee who needed a hip replacement and found a freestanding orthopedic surgery center that cost $20,000 less than a hospital-based facility and had a higher quality rating.

"Being able to share information about how to shop for health care and how not everyone charges the same price for everything and — oh, there's actually a difference in quality depending on where you go — was eye-opening," she said.

During the first four years, the district paid out an average of $15,000 per year in bonuses. The county has calculated that for every $1 it spends offering Healthcare Bluebook to its employees, it saves $3.50.

Andrea Bilderback, a county health promotion and outreach specialist, used the tool when deciding where to get a mammogram and colonoscopy after she recently turned 40. She ended up getting a check for $100 for the colonoscopy and $35 for the mammogram, neither of which had any out-of-pocket costs. She and her husband used the money for a date night, a welcome change for the parents of a 1½-year-old boy.

“It was like free money,” Bilderback said.

Such incentives have been used across the country with varying degrees of success. Self-Insured Schools of California, a purchasing alliance that represents 450 school districts in the Golden State, implemented a similar system years ago. Officials compared the prices they paid for five common procedures — arthroscopies, cataract surgeries, colonoscopies, upper GIs and endoscopies — at hospitals with freestanding surgery centers. They found that surgery centers are generally significantly cheaper and the care is often rated as better. The group capped the amount of money it would pay hospitals, leaving employees on the hook for any remaining amount. If they went to a surgery center, there would be no cap.

eBook Cancer Research

Compilation of the top interviews, articles and news from the last year. Download a free copy

For example, arthroscopies were capped at $4,500. So if a hospital charged $6,000, the patient could be billed for the remaining $1,500. But if that patient went to a surgery center, the plan would cover the entire cost, regardless of the amount.

In its first year, which began October 1, 2018, the new approach had shifted 54% of procedures from high-cost hospitals to lower-cost surgery centers, saving school districts $3.1 million in healthcare costs.

“If you could pay $25,000 or $75,000 for a car and the only difference was the dealer overhead, why would you pay $75,000?” said John Stenerson, deputy executive director of Self-Insured Schools of California. “It’s kind of like what we do with drug pricing all the time.”

The Colorado Alliance conducted a similar analysis of the 10 most common outpatient procedures paid for by its employer members. Even before rates are negotiated, these employers could cut their costs for these procedures in half by sending employees to surgery centers instead of hospitals. Surgery centers typically charge less than hospitals for the same procedures, and hospitals often charge a facility fee, increasing costs for consumers and employers. A Recent study found that costs for a range of orthopedic procedures were, on average, 26% lower in ambulatory surgery centers than in hospitals.

The cash back incentive program is part of a broader effort by the Colorado Alliance to reduce health care costs for state employees and 12 other employers, primarily school districts and local governments. But state officials give the alliance a sizable block of insured lives and greater bargaining power with doctors, hospitals and other health care providers.

Robert Smith, head of the Colorado Business Group on Health, which leads the alliance, believes the purchasing alliance model can revolutionize the health care market and harness the power of employers to drive down costs. Most companies, he explained, pay premiums to a health plan to cover their employees, but allow those health plans to negotiate rates with hospitals, doctors and other providers. It would be too complicated and time-consuming for most companies to take on this role themselves.

On the other hand, healthcare purchasing alliances allow employers to band together and negotiate rates for a much larger group of workers, giving them greater market power to negotiate lower rates.

“Health care outcomes are unrelated to price,” Smith said. “You can pay twice as much for some of the worst health care at one facility, and then you can get some of the best health care for half the price at another facility 10 miles away.”

But if employers change the way they buy health care, it could create a competitive market, Smith said.

To date, most negotiated rates have been limited to providers in Colorado's populous Front Range region, which includes Denver, Fort Collins and Colorado Springs. The alliance is trying to recruit providers in other areas, particularly in the western part of the state, but it could take three years or longer to fully transition to the new model.

Purchasing cooperatives have been tried in other parts of the country with limited success. A report of the nonprofit Catalyst for Payment Reform found that such alliances often had early successes but failed to survive, in part because of the responses of large health systems. These systems often undercut the prices of purchasing alliances to drive them out of business.

So far, Smith has negotiated with freestanding ambulatory surgery centers, imaging facilities and physician-owned clinics. But he's had little luck getting the larger health systems to play ball.

"If it's so disruptive that it impacts their bottom line and they notice it," said Benn, the state's head of employee benefits, "then, yes, I think they'll come to the table."

|

|

.

Suche

Suche

Mein Konto

Mein Konto